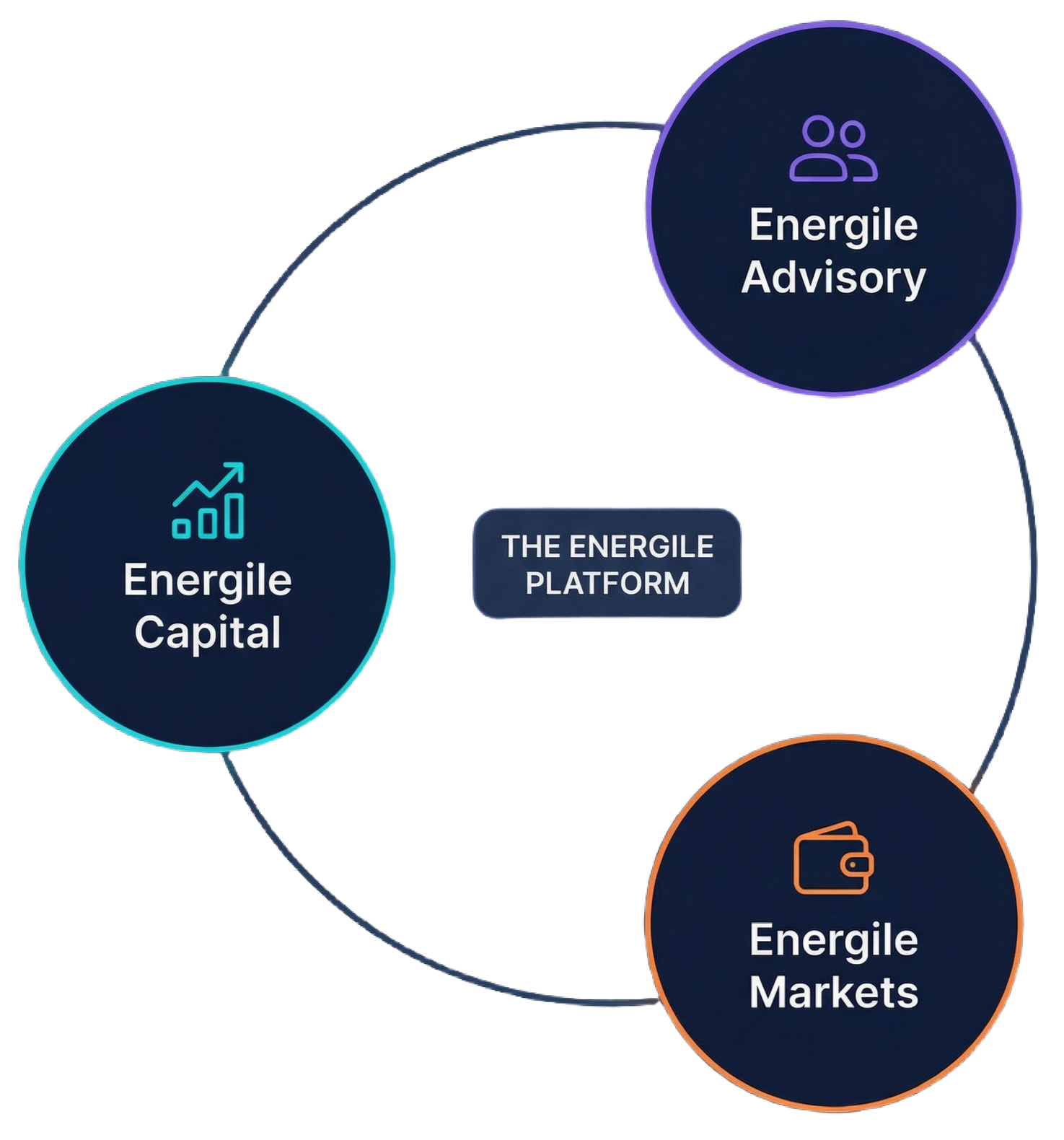

One Platform. Three Integrated pillars.

Where Capital, TransactionS, and Markets Converge.

Energile Markets

Market Access and Trading Across Power, Gas, and Carbon

- Revenue structuring and market access

- PPA structuring

- Wholesale market

- Hedging and risk management

- Carbon Certificates

- Guarantee of Origins (GoOs)

- Designing Strategy for revenue maximization